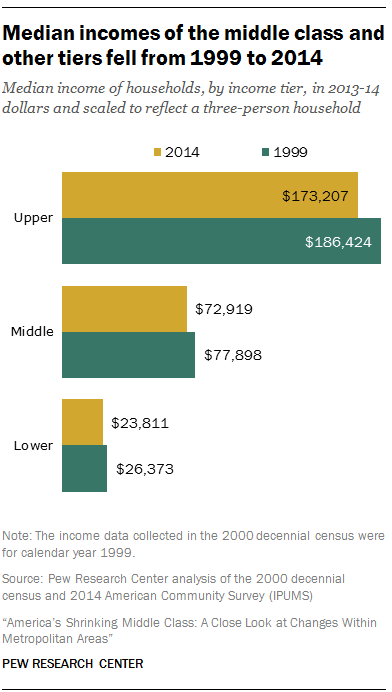

Forgiving student loans only makes that problem worse. The rapid inflation in the cost of college is, in large part, due to rampant government subsidies in higher education. Meanwhile, the economic value of many four-year degrees has declined. Finally, it does nothing to address the affordability problem in higher educationĪccording to Forbes, between 19, the cost of a college education jumped 169%.Once again, government policy is punishing hard work. But the unfairness extends to many middle class families as well who worked hard to pay off their student loans or their children’s student loans. We’ve already discussed how the poor and working classes are treated unfairly by this plan. But in reality, this approach simply transfers the burden onto the backs of taxpayers. The White House has labeled the plan a “forgiveness” of student loan debt. This demographic spends a disproportionate share of their income on essentials like food and gas that have seen the most dramatic price increases in recent months.Īs the Brookings Institution points out, $10,000 in debt forgiveness “would involve a transfer that is about as large as the country has spent on welfare … since 2000 and exceeds the amount spent since then on feeding hungry school children in high-poverty schools through the school breakfast and lunch program.” It will contribute to already high inflationĪnother way this plan hurts the poor and working class is by increasing inflation.Here are four additional ways that student loan forgiveness is ill-advised: Yet under the Biden administration’s plan, they will bear the burden of paying off the student loans of their wealthier neighbors through their tax dollars. Many of these individuals are working service-oriented jobs, entry-level positions, or laboring in the skilled trades. We believe the White House’s plan is wrong on many levels, but a top way is the way it unfairly penalizes the poor and working classes, which disproportionately do not have college degrees and have not attended any college at all. This doesn’t come through cycles of generational government dependence, but through career training and credentialing that provides the pathway to fruitful full-time work and, ultimately, a better life. Here’s what your income says about you, your community and the country. The plan applies to households making up to $250,000 a year (or $125,000 for individuals), an income threshold that targets the middle class and upper middle class and many high-earning professionals.Ī core part of our mission at the Georgia Center for Opportunity is to give the poor and working class a leg up on the economic ladder. Up to 87 of Americans identify as middle class but few agree on what that means. This article originally appeared on GOBankingRates.This week, the Biden administration announced a plan to forgive up to $20,000 in student loan debt for millions of Americans. In order to find out how much a middle-class family is earning, GOBankingRates multiplied each median income by 0.67 for the lower limit and by 2 for the upper limit. For this study, GOBankingRates assumed that a middle-class family earns two-thirds to double the median income for a family of its size in its state. Pew Research Center defines middle class as making two-thirds (67%) to double (200%) the national median income.

Census Bureau’s 2019 American Community Survey data to determine how much a two-, three- and four-person middle-class family earns. Methodology: GOBankingRates found how much the middle class earns in every state by analyzing the U.S.

#Upper middle class income georgia how to#

What It Means To Live a Truly Rich Life and How To Achieve Itīig Personal Goals That You Should Put Your Money TowardĬynthia Measom contributed to the reporting of this article. Read About the Best Small Businesses in Your State DenisTangneyJr / Getty Images/iStockphoto WyomingĢ-person family middle-class income range: $49,018 to $146,322ģ-person family middle-class income range: $54,955 to $164,046Ĥ-person family middle-class income range: $64,195 to $191,628įollow Along With 31 Days of Living Richer

0 kommentar(er)

0 kommentar(er)